Investment properties

Seize opportunities, build wealth: investment properties in focus

For retirement planning or wealth accumulation: investment properties are very popular. This is because a property is considered to have stable value and can provide additional income in the form of rental payments. But real estate prices are rising sharply in many places. The question therefore arises, are investment properties still worthwhile?

Real estate – who bears what costs?

Home

- Operating costs – I

- Loss of value – I

- Interest & Redemption – I

Capital investment

- Depreciation – State

- Operating costs – tenants

- Cash Flow – Tenants

- Interest & Repayment – tenant

The property as an investment

Fixed-term deposits and current account accounts hardly produce any returns. But the alternative funds and stocks are not an option for everyone. If you want to avoid fluctuating prices and low interest rates, you can choose the property as an investment. Because the so-called concrete money is considered to have stable value and is not dependent on the development of the stock market.

Using investment properties means investing your savings in real estate. For example, by participating in a building cooperative or paying off real estate loans. The capital flows in the form of rental payments, which are recorded as regular income, or, if the property is occupied by the owner, through its increase in value and the return on sale or the forgone rent. In this case, the property also functions as retirement provision. Because if you don’t have to pay rent in old age and live in a paid-off property, you will have more of your pension left.

- Stable investment form

- Rent payments as a regular source of income

- Retirement provision

Stable in value and full of opportunities

Acquiring a property means making a long-term investment. However, real estate is hardly subject to fluctuations in value and often even increases in value. Especially in regions with strong demand. The location is crucial here. Anyone who buys or builds near city centers, doctors, kindergartens, schools and connections to public transport also benefits financially from the good location.

This means that investment properties have a high chance of making a profit, as their value usually increases, they can be sold at a profit. Or rent it out, which promises additional and regular income. If you live in the house or apartment yourself, you don’t have to pay rent and save hundreds of euros a month when the property is paid off.

Tax benefits

An investment property is also interesting from a tax perspective. If the property unexpectedly loses value, the loss in value can be claimed as a tax deduction. As a landlord, you can also deduct advertising costs. Owners who live in their home can declare expenses such as homeowners insurance, household-related services and the costs of repairs, maintenance and modernization in their tax return.

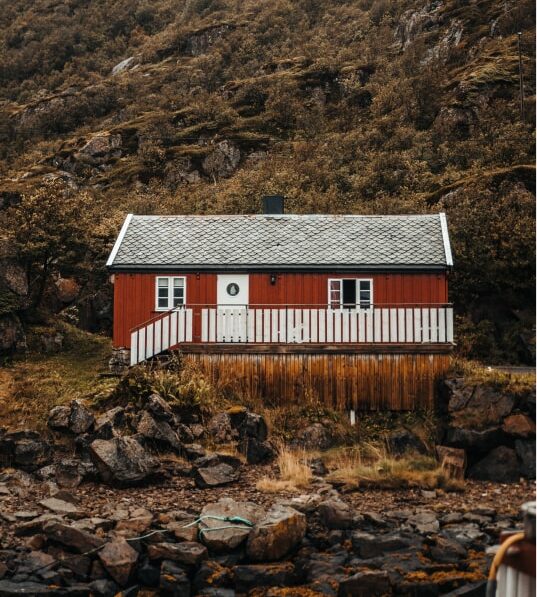

Home is looking for a new owner

The term “financing” describes the provision of financial resources and their repayment. To do this, borrowers agree on certain conditions with their lender, which sometimes include the amount of interest (costs for providing capital) and the term.

Take advantage of low interest rates

Ten years ago, builders had to budget an interest rate of four percent for real estate financing. 20 years ago even up to eight percent. Anyone who finances today pays significantly less. Depending on your personal situation and lender, construction financing is possible for one percent or less. This means that your own home or capital investment can be realized at particularly favorable conditions.

However, a loan is a long-term obligation. Anyone who takes out a loan of 400,000 euros usually has to plan between 25 and 35 years – possibly even longer – for repayment. A lot can happen during this time. Forward-looking planning is therefore essential, such as a term life insurance for emergencies to protect the surviving dependents, or a occupational disability insurance when one’s own labor is lost and no income is generated any more.

Despite all the advantages, buying a property as an investment must be well thought out. This comes with obligations such as repayment of the loan and expenses for repairs. Anyone who rents out the property in order to pay the installment must always be prepared for the possibility of loss of rent, which can have expensive financial consequences for the owner.

Individual reports – complete check for a free life

Private and commercial reports

With the financial and insurance report you will receive independent instructions and recommendations to optimally set up your pension status – for a free life, no matter what happens!

The location is crucial for an investment property

It cannot be emphasized often enough how important the location is for an investment property. Because it depends on whether the investment is worthwhile in the long term. However, a distinction must be made as to whether the property is used personally or rented out. Because whoever lives in the house or apartment decides based on personal considerations. However, anyone who rents, must take the perspective of the potential tenants.

Kindergartens and schools should be nearby if the property is to be rented to families. Older people may be less mobile, making close proximity to shopping, doctors and public transportation important. Students value good connections to the university, nightlife, trains and buses. All of these factors are also crucial in determining whether the value of the property increases and rental income remains stable.

Looking at the future of the region

Not only the obvious location prospects are crucial when choosing an investment property, but also a future view of the region. It is important to check what the economic prospects of the place look like. Is investment being made to create building plots and commercial areas? What is the population development and is there a large supply of vacant apartments? The vacancy rate on the housing market in particular provides information about how good your chances are as a landlord. Because many vacant properties indicate that there is little demand.

Keep an eye on the purchase price

The more expensive the property, the more difficult it is to achieve returns. An investment property therefore makes sense if the purchase price is not excessive and is appropriate for the region and the property. The rental price multiplier provides information about whether the price is in an appropriate relationship to the achievable income. It indicates how many annual net rents are necessary to refinance the investment. The local rent index can be accessed online.

An example: A condominium should be purchased for 300,000 euros. The annual net rent to be achieved is 12,000 euros. It takes 25 years (300,000 euros / 12,000 euros) until the purchase price is financed through the rental income.

A period of 20 to 25 years is considered appropriate. In larger cities where purchase prices are high, it can also be 30 or 35 years. The age of the investors and the length of time until the expected start of retirement must be taken into account.

»In this day and age, it is an asset to know such a professional and competent financial service provider. Absolutely empathetic. No saleswoman. Rather, accompaniment with heart and mind.«

Satisfied SaFiVe customer

Is an investment property still worth it?

In principle, investment properties are still worthwhile. Especially now, as the key interest rate is low and loans are available on favorable terms. There is also high demand for rental properties, especially in metropolitan areas, which reduces the risk of vacant assets. However, this is countered by the fact that real estate prices have risen sharply in recent years. If you want to buy in big cities, you have to expect horrendous sums. An investment property is therefore worthwhile if the ratio is right. If the purchase price is reasonable in relation to the location and condition of the property. And the value of the property is likely to increase or high rental income can be expected. Anyone who lives in the property themselves must take into account that the loan should ideally be repaid before the start of retirement.

Alternative to the investment property: the care property

Care property is an interesting and sought-after investment. Investors do not purchase a residential building or condominium, but rather invest their capital in a senior residence. This means that the rental income is very secure and the tax advantages remain. Depending on the contract, investors can also live in the property in the seniors’ residence themselves. This means they benefit from guaranteed rental payments as an additional source of income when they are younger. And when they get older, they can move into age-appropriate living themselves. This makes nursing properties both an investment with the potential for returns and a good retirement provision.

Real estate as an investment: Get advice now

An investment property offers many advantages. But the investment is only worthwhile if essential factors are taken into account. The location and the building structure are crucial for the return. And the purchase price is also essential for a worthwhile investment.

Anyone who invests in real estate has to take a few things into account. As an expert for finance and insurance and an independent insurance broker from Aschaffenburg, I would be happy to help you. I will answer all your questions about investment property and also advise you on alternative investment products.